Intro

“Will my money last in retirement?”

“How do I replace my paycheck?”

“What are the tax implications?”

“Should I turn on social security income early or later?”

“How do I preserve my assets and still grow them?”

These are the questions we hear every day from pre-retirees, and here is the framework we provide to help you create a reliable income stream while protecting and growing your assets over time. There are 5 key concepts we will cover in this article:

- The GAP (or surplus) formula

- The 4% Withdrawal Rate

- Sequence of Return Risk

- Time Horizon vs Risk Tolerance

- The 3-bucket system

Framework

1. The GAP (or surplus) formula

Do you have a monthly shortfall (GAP) or surplus? Most people, even after turning on Social Security, will have a deficit between their income and spending. To calculate what that is, use the following formula.

Your Annual GAP or surplus is equal to:

+ Your Total Annual Guaranteed Income

— Less: Your Total Annual Spending (including taxes)

Annual Guaranteed Income – There are 3 sources of guaranteed income: Social Security, pensions, and annuities. Adding up all three of these gives you your guaranteed income.

Total Annual Spending – this is your total spending, including mortgage/rent, eating out, entertainment, insurance, property taxes, healthcare, income taxes, etc.

Your Annual Surplus or Gap – if your guaranteed income exceeds your expenses, congratulations! You have a surplus, in which case you can still look to optimize your income by creating tax-efficient distribution strategies.

If you are like most Americans, and your guaranteed income is less than your expenses, then you are going to be drawing from your savings, investments, and maybe even your home equity, to fill in that gap.

Here’s an example:

John and Sally Smith have…

Monthly Guaranteed Income = $7k

- Social Security = $3k

- Pension = $3k

- Annuity =$1k

Subtract: Monthly Spending = $9k

Equals: Monthly Shortfall of $2k, Annual Shortfall of $24k

In the example above, this couple spends $24k per year and has $1M in savings, corresponding to a 2.4% withdrawal rate.

24K ÷ 1M = 2.4%

2. The 4% Withdrawal Rate

Research has shown that if you withdraw 4% or less of your portfolio for retirement spending, the likelihood of spending through your investments/savings is minimized. We generally advise clients that 3.5% or less is a more conservative target, especially given the current interest rate environment, which is lower than when studies on the 4% withdrawal rate were conducted.

3. Sequence-of-return risk is the risk that poor investment returns early in retirement can drain your portfolio faster, even if long-term average returns look good.

The timing of your investment gains and losses matters just as much as the average return—especially when you’re withdrawing money, like in retirement.

Here’s the simple explanation:

- Imagine two people earn the same average return over 20 years.

- But one experiences big losses early on, while the other experiences them later.

If you’re still contributing (saving money), early losses aren’t as harmful because you’re buying into the stock market at lower prices.

If you’re withdrawing (retirement), early losses can be disastrous because:

- Your investments drop in value, and

- You’re withdrawing from a smaller balance, which makes it harder for the portfolio to recover.

To use an analogy, think of your retirement savings like a bucket of water:

- If the bucket gets smaller (market drops) while you’re scooping water out (withdrawals), it empties much faster.

- If the bucket gets smaller before you start scooping, you can refill it over time.

4. Time Horizon vs Risk Tolerance

When determining how to position your assets, your time horizon (the time until you need to access the money) is more important than any other factor, including your risk appetite. The reason? The more time you have, the more risk you can take because volatility in asset classes like stocks and real estate tends to normalize (revert to a mean) over time.

For money that you will need to spend in the next few years, you do not want it in the stock market because it could hypothetically decrease in value more than 40%, as stocks did in 2008. However, over the long term, the stock market has delivered returns that outpace inflation. Therefore, we recommend mentally, and even physically, compartmentalizing your money into buckets…

The mistake we see folks make? They put all of their money into US Treasuries, bonds, or cash when they retire, or they keep all of their money invested in stocks. More than likely, your approach needs to be more nuanced than this. Being too conservative means inflation could be outpacing your portfolio, and being invested in all stocks exposes you fully to the sequence of return risk.

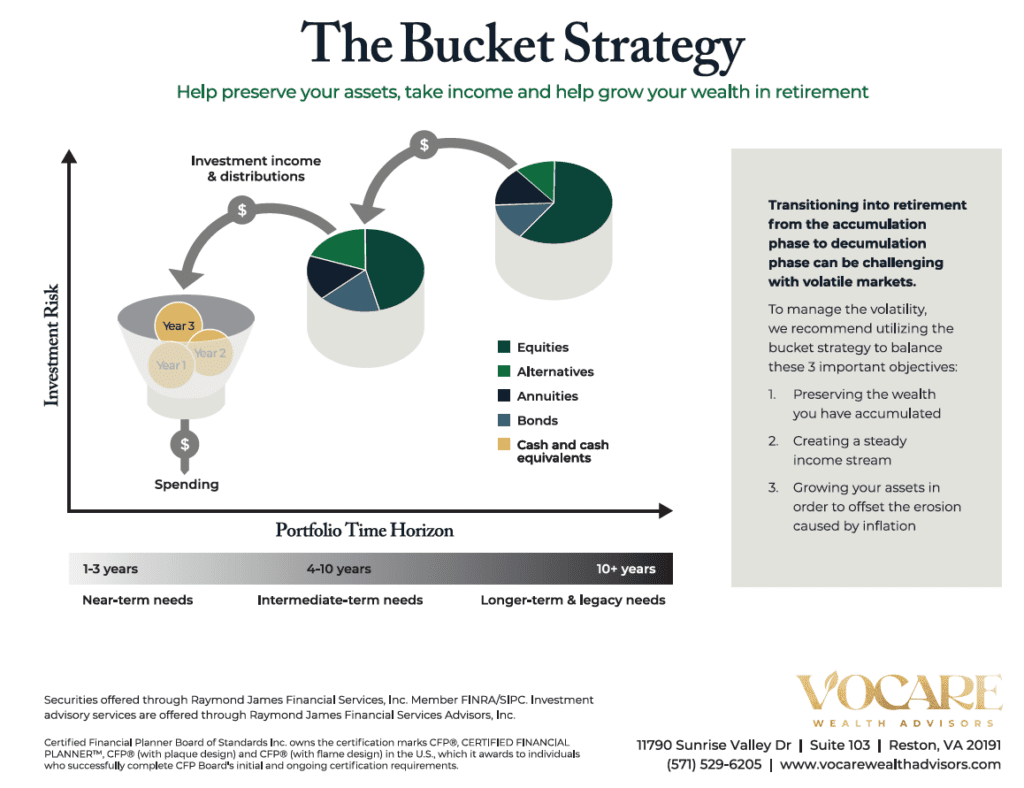

5. The 3-bucket system

How do you balance the competing goals of preserving your assets in retirement, creating an income stream, and also growing your assets to outpace inflation?

We recommend applying a bucket strategy with 3 buckets:

- Short Term

Once you know your annual income need (your gap), you can multiply that by 3 to give you a 3-year buffer (or bear market cushion), and that is the amount you will keep in high-yield savings/money market that is liquid and accessible for your spending. - Intermediate Term

This is money you might touch in the next 4-10 years, that you want to keep pace with inflation or outpace inflation. That means investing it in assets that have the potential to grow beyond what a high-yield savings account can do. - Long Term

And last, the long-term bucket is money you will not touch for 10 or more years. This is the bucket you can be most aggressive with to outpace inflation, because your time horizon is much longer, you can take more risks, and hold your investments during periods of volatility.

As you spend from the spending bucket, you will refill it from the intermediate bucket, and the intermediate bucket will be refilled from the long-term bucket.

Applying this framework helps you balance the competing interests of preserving your assets, generating a steady income, and growing your assets to offset inflation.

We recommend you start compartmentalizing, mentally and physically (e.g., create separate accounts: IRA short term vs. IRA intermediate term vs. IRA long term), 5 years before retirement, rather than waiting until the year you retire. Due to the sequence of return risk, if you don’t rebalance before retirement, you could retire into a stock market that is performing poorly, severely setting back your probability of success for retirement.

We specialize in helping retirees create tax-efficient, sustainable retirement income through our Vocare Reliable Retirement Income PlanTM process.

We want you to Retire With Purpose!

The Vocare Wealth Advisor Team

Any opinions are those of the author and not necessarily those of Raymond James. This material is being provided for informational purposes only and is not a complete description, nor is it a recommendation. There is no guarantee that these statements, opinions, or forecasts provided will prove to be correct. Investing involves risk, and you may incur a profit or a loss regardless of the strategy you select. No investment strategy can guarantee your objectives will be met. Past performance is no guarantee of future results. Every investor’s situation is unique, and you should consider your investment goals, risk tolerance, and time horizon before making any investment decision.